IRS: Teachers Can Deduct Out-of-Pocket Expenses for COVID-19 Supplies

It's no surprise really that almost all teachers have to reach into their wallets to pay for a variety of things for their classrooms. From tissues to crayons to things that enhance the learning experience, teachers have been forking over their own money for these things for years.

And then the pandemic struck. Suddenly instead of just having to pay for learning supplies, many teachers found themselves needing to buy COVID-19 protective supplies.

While most all school districts provided some of the basics, teachers have still had to replenish or supplement supplies of things like face masks, disinfectants, hand soaps and sanitizers, and more.

The United States Internal Revenue Service recently announced it will allow educators to deduct out of pocket expenses for COVID-19 protective supplies. These supplies include,

- face masks;

- disinfectant for use against COVID-19;

- hand soap;

- hand sanitizer;

- disposable gloves;

- tape, paint or chalk to guide social distancing;

- physical barriers (for example, clear plexiglass);

- air purifiers; and

- other items recommended by the Centers for Disease Control and Prevention (CDC) to be used for the prevention of the spread of COVID-19.

An eligible educator is anyone who teaches kindergarten through 12th grade, is an instructor, counselor, principal, or an aide in a school that works at least 900 hours each school year.

According to the IRS, those educators who are deemed eligible will be allowed to "deduct up to $250 of qualifying expenses per year ($500 if married filing jointly and both spouses are eligible educators, but not more than $250 each)."

To learn more about this new allowed deduction or to find necessary tax forms, visit the IRS website.

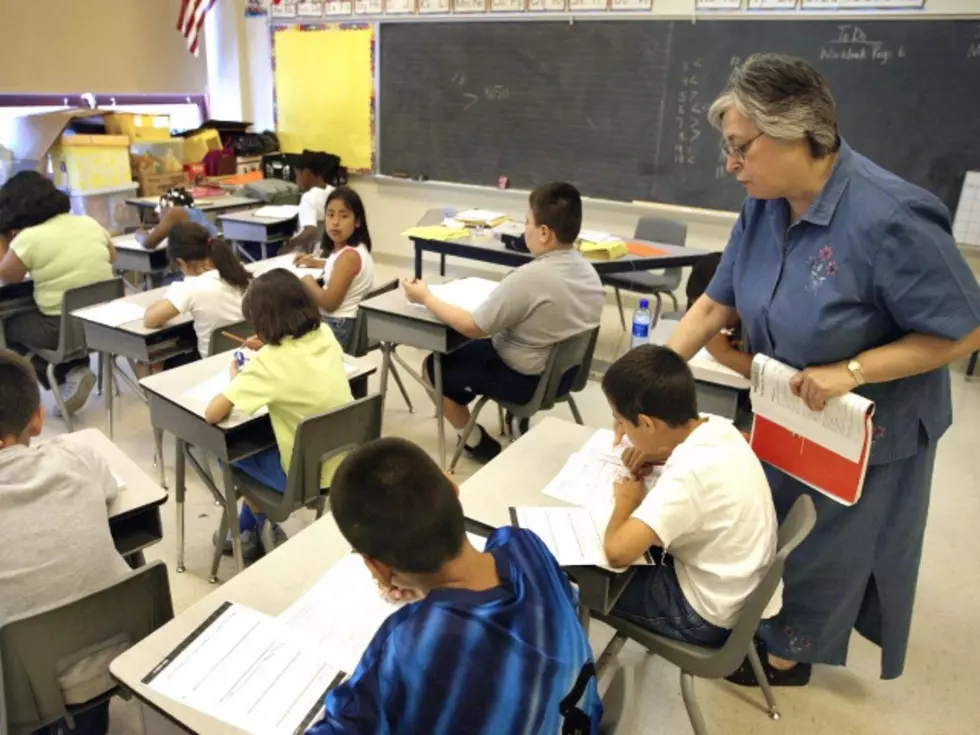

In Pictures: What Education Looks Like Around the World During a Pandemic

More From Lite 98.7